Hispanic Shopper

Beauty Research Study

Makeup and Skincare

Authors

Natasha Pongonis - O.Y.E. Business Intelligence CEO

Christian Arenas - O.Y.E. Business Intelligence Digital Analyst

Daniela Rubio - Intercultural Studio CEO

About the Study

O.Y.E. Business Intelligence and The Intercultural Studio have partnered to implement a mix-method approach to identify key attitudes and behaviors around beauty products among Hispanic consumers.

Multicultural consumers are not only transforming the US mainstream market but driving the buying power with an estimated $3.2 trillion in 2018. As America grows more diverse, understanding behavior and minority consumers' preference is becoming a top priority for brands. The objective of this study, is to identify cultural behavior and understand how Hispanic customers act and interact with beauty products, what influences their actions so brands can talk to the right audience, through the right channel, with the right message, and language.

About O.Y.E.

O.Y.E. listens to consumers in their own space online and delivers insight on what multicultural consumers have to say about your brand and/or industry. Understanding consumer attitudes towards brands, their products and their marketing efforts provides our clients insights that inform their multicultural marketing strategy.

Actionable Insights

O.Y.E. is a language-neutral social listening software that analyzes conversation in all languages to derive meaning from unstructured social conversation among multicultural consumers. O.Y.E.’s natural language processing solution is designed not only to identify Black and Hispanic U.S. consumers of all levels of acculturation, but to also derive insights marketers can use in campaign strategy, messaging, and targeting.

The Solution

Insights derived from social conversation by O.Y.E. provide key details into multicultural consumers through their own statements about brands/industries. O.Y.E. analyzes that conversation to allow companies to understand better ways to interact with these groups. O.Y.E. also provides insights on how to create campaigns tailored to these multicultural consumers.

The Value

Leveraging insights from O.Y.E. allows clients to produce content for multicultural consumers most influential over purchasing decisions for organizations where they want it, when they want it and how they want it. The result: Better conversion, lift, and engagement.

About The Intercultural Studio

The Intercultural Studio specializes in consulting through a holistic offer that will help your team fully uncover the WHY's to your organization’s questions and experience what other cultures value. Intercultural specializes in the Hispanic culture (markets and countries) and focuses on understanding the meaning through a business and educational lens. The services include qualitative & ethnographic research, cultural immersions, transcreations, and intercultural strategy and innovations.

In the past, Intercultural Studio's projects have answered market research questions related to consumers, behaviors, attitudes and needs. The projects have helped answer business questions related to product usability, market positioning, brand equity, market entry, market share, competitive analysis, benchmark studies, market size and share, communication strategies, pricing testing, concept testing, and exploratory research. The team is composed of seasoned moderators, recruiters, analysts and strategists (RIVA trained). Intercultural Studio selects the markets according to the research question and client needs. Typically, Intercultural chooses the most representative markets for Hispanics and Latin America. Intercultural Studio conducts online qualitative research using the most advanced technology and platforms, shop-alongs, party groups, ethnographics, focus groups, dyads/triads, deep dive interviews, expert interviews.

Methodology

O.Y.E. Business Intelligence

This analysis was extrapolated from a data set of 521,796 (307,559 makeup and 214,237 skincare) total conversations on Twitter, of which 31,345 were from verified Hispanics. All the data was gathered from 04/01/2019 - 6/30/2019.

The Intercultural Studio

The Intercultural Studio recruited 20 participants that matched a certain criteria (see below) to participate in a 1-hour online interview at the beginning of June 2019. The criteria of the respondents included:

Geography: Nationwide/Hispanic Markets - focus on California, New York, Texas, Florida, and Illinois

Language: 50% Bilingual and 50% Spanish only speakers

Education: Must have completed at least some college (soft quota)

Age: Between 25-60 years old

Gender: 50% female and 50% male

Marital status: mix

Income: Min $35,000

The analysis was done using a combination of qualitative analysis expertise from a team of Anthropologists, Sociologists, and Interculturalists. Additionally, during this study, The Intercultural Studio wanted to test a new approach using AI technology that provided fast-turnaround transcriptions from the audio through machine learning algorithms as well as identification of the words (brands) that were mentioned throughout all the online conversations.

Goals & Objectives

Qualitative Approach - Objectives

- Identify key brands and products that are relevant for makeup and skincare. These words will be integrated into the O.Y.E. Intelligence search query

- Understand emotional drivers & goals as they relate to shopping/buying for beauty products

- Identify themes and patterns as they relate to Hispanic identity, culture, values, lifestyle, and insights into what makes this target unique

- Explore current behaviors and attitudes around shopping for beauty products

Social Listening Approach - Objectives

- Understand consumer behavior among Hispanics analyzing online conversations in the beauty industry that may include hair, face, and body products. The focus of this report is on the industry, not on specific brands. However, we may include insights about brand or product preferences if any recurring mentions are found.

- Online vs in-store shopping if data shows a trend during the selected time period

- Takeaways and recommendations for brands or marketers

- Identify 5-10 influencers that brands or organizations could consider for campaign activation. These influencers will be chosen based on their passion for products, engagement rate, audience geography (the majority of each influencer’s audience must reside in the US), follower growth rate, comment quality (are the comments relevant to the content).

10 Key Questions Driving The Study

Study Content

Volume Analysis | Language Analysis | Gender Analysis | Sentiment Analysis

| Location Analysis | Topic Analysis | Influencers | Top Shared Posts | Wordcloud |

Conclusion

Volume Analysis

Volume Analysis - Makeup

- During the time range of the analysis, there were 307,559 total online makeup conversations of which 19,699 were identified as Hispanics

- Hispanics made up 14.4% of the total amount of conversations which is within the average Hispanic percentage range we typically see in studies (10% - 15%)

- Hispanics were the second biggest ethnicity posting about makeup online behind White Americans (74.8%)

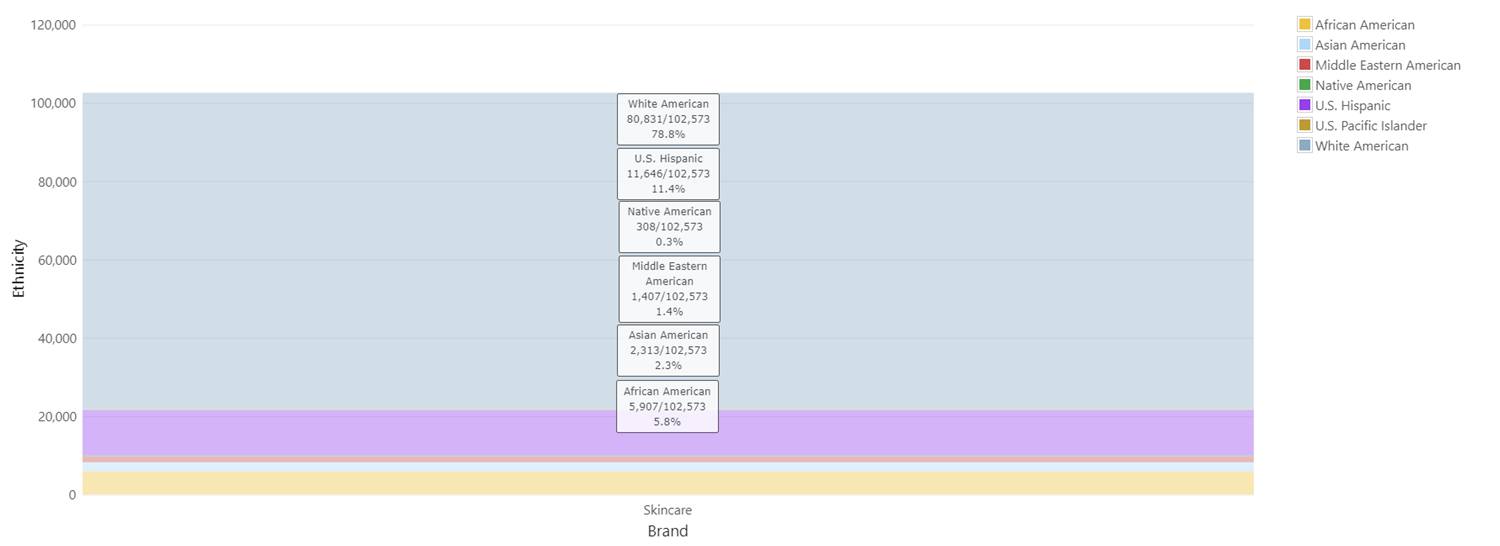

Volume Analysis - Skincare

- During the time range of the analysis, there were 214,237 total online skincare conversations of which 11,646 were identified as Hispanics

- Hispanics made up 11.4% of the total amount of conversations which is within the average Hispanic percentage range we typically see in O.Y.E. studies (10% - 15%)

- Makeup (14.4%) had a larger Hispanic percentage than skincare (11.4%). This indicates that, for Hispanics, makeup is a more popular topic than skincare. In terms of volume, makeup had around 8K more posts

Language Analysis

Language Analysis - Makeup

- For makeup, English-speaking Hispanics (91%) made up the majority of online conversations followed by Bilingual (5.1%) and Spanish (3.9%)

- It was common for English posts to come from a younger demographic of Hispanics

- Spanish posts were most common among the older Hispanic demographic

- Here is an example of a Spanish post from Danya Fernanda who posts about how she ran out of makeup primer and doesn't know which one to buy so she asks twitter for any recommendations

Language Analysis - Skincare

- For skincare, English-speaking Hispanics (84.9%) also made up the majority of online conversations followed by Spanish (9.7%) and Bilingual (5.4%)

- Important to note, both Spanish and Bilingual conversations had a higher percentage for skincare (9.7% and 5.4% respectively) than for makeup (3.9% and 5.1% respectively)

- While English speaking Hispanics dominated in both makeup and skincare online conversations, Spanish and Bilingual speaking Hispanics have a much stronger presence when posting about skincare

- There was a 5% increase for Spanish posts between makeup and skincare. This indicates that for Spanish speakers, skincare is very important to them and thus much more active about it online

Gender Analysis

Gender Analysis - Makeup

- For makeup, Hispanic females made up 76.1% of total online conversations meanwhile Hispanic males made 23.9%

- When it came to Hispanic males, the most common topic was to retweet about makeup products

- Here is an example from Alex Aguilar retweeting a post from Jeffree Star and his new lip gloss product launch

- Interestingly, Hispanic males found it attractive when females did their makeup or simply took care of themselves

- Here is an example from Jorgie from Chicago who posted about how female self care is very attractive to him

- Hispanic females would post online either looking for other products to try, reviews, recommendations, or to see what new products their beauty influencers were posting about.

- Here is an example from Maria Munoz who posts about needing to review the Jeffree Star Magic concealer product

- Posts that were very popular among Hispanic females were posts that showcased the product in use such as this post about Pat McGrath lipgloss

Gender Analysis - Skincare

- For skincare, Hispanic females made up 64.9% of total online conversations meanwhile Hispanic males made 35.1%

- Compared to the makeup gender analysis, the skincare gender analysis was more evenly distributed between Hispanic males and females

- A popular skincare product that both Hispanic males and females were big fans of were face masks

- Here is an example from Mike Cisneros who posts about wanting a girlfriend to do face masks with and buy skincare products

Sentiment Analysis

Sentiment Analysis - Makeup

- Among Hispanics, positive sentiment (68.8%) was much larger than negative sentiment (31.2%) online conversations

- A major conversation driver for positive sentiment was how makeup made them feel more confident. Hispanic females commonly would post about how great they felt whenever they had their makeup done right

- Similar to skincare, Hispanics felt great after doing their makeup routine whether that was because they felt more beautiful or just satisfied with the end result

- Here is an example from a Hispanic female posting about how she loves when guys compliment her about her makeup and that she puts time into making herself feel great

- Lipsticks and lip glosses were the two main products that drove positive sentiment for makeup

- Here is an example from Vanessa Aguila posting about how much she loves dark lipstick

- Here is an example from Yuli who posts about her love for lip gloss as well as posts two images of her wearing the makeup product

- While negative sentiment (31.2%) was high for makeup this was due to Hispanic females mentioning that they felt like a bad bit** when they had their makeup on. Even though it is a swear word it has a positive connotation and a result actually a positive post

Sentiment Analysis - Skincare

- For skincare, positive sentiment (78.2%) conversations also made up more Hispanic online conversations than negative sentiment (21.8%)

- A major conversation driver for positive sentiment skincare conversations were how great and refreshed people felt after doing their skincare routine

- The major negative sentiment conversation drivers were products that irritated the skin and other products that were causing micro tears in the skin. The most popular being walnut exfoliators

Location Analysis

Location Analysis - Makeup

- The top 10 US locations for makeup were Los Angeles, New York City, Miami, Chicago, Houston, San Bernandino, Dallas, Anaheim, San Antonio, and El Paso

- The top 3 US locations were all big cities where Hispanic population is very large: Los Angeles (13.1%), New York City (9.2%), and Miami (8%)

- Jeffree Star is a beauty influencer, with a significant follower count (5.2M followers), and he also resides in Calabasas, CA which is in Los Angeles County. This caused the volume for Los Angeles to increase significantly

- California and Texas were the major players when it came to makeup online conversations. Four Texan cities appeared in the top 10 US locations meanwhile three Californian cities appeared in the top 10 US locations

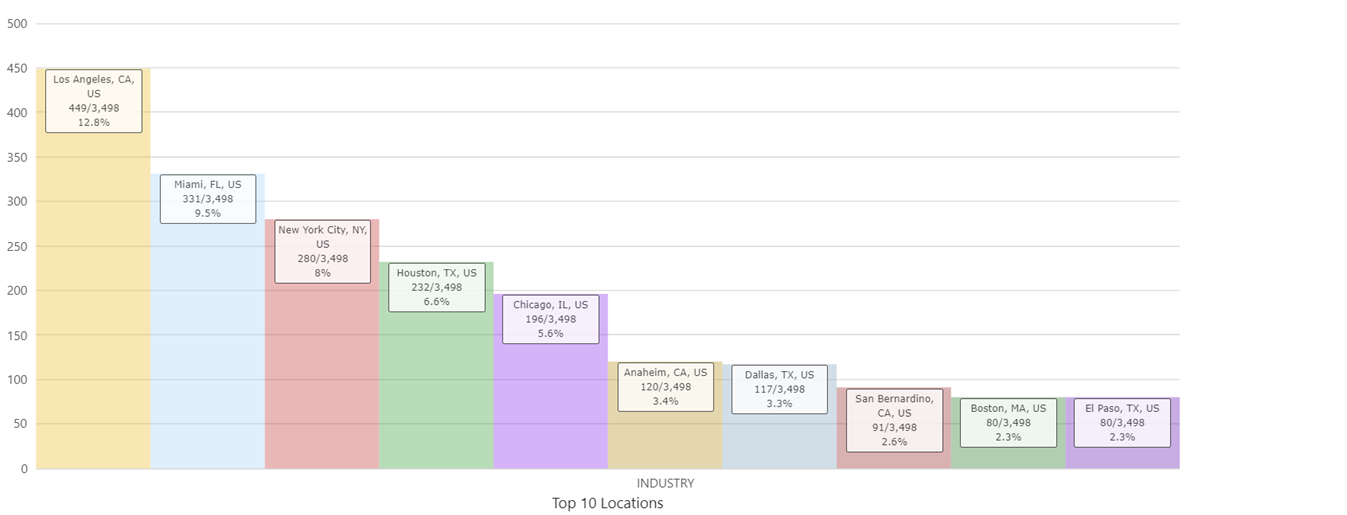

Location Analysis - Skincare

- The top 10 US locations for skincare were Los Angeles, Miami, New York City, Houston, Chicago, Anaheim, Dallas, San Bernandino, Boston, and El Paso

- The top three US locations were the same cities as for makeup except with Miami bumping up to second and New York City to third. This indicates that Los Angeles, Miami, and New York City are all important cities when it comes to the beauty industry

- Important to note, California and Texas were major players for U.S. Hispanic skincare conversations. California (Los Angeles, Anaheim, and San Bernardino) and Texas (Houston, DAllas, and El Paso) both had 3 cities among the top 10 US location graph

Topic Analysis

Topic Analysis - Makeup

- O.Y.E.'s topic analysis categorizes online conversations for each brand into categories to dive further into the data and get a deeper understanding of what consumers' are talking about on social channels

- For makeup, the top categories during the time range of analysis were Lipsticks (34%), Lip Glosses (25%), Concealers (17.3%), Future Purchases (2.7%), and Recommendations (2.6%)

- The most popular products mentioned among Hispanics during the time range of the analysis were Lipstick (34%), Lip Gloss (25%) and Concealers (17.3%)

- Here is an example from Jennifer Vasquez who posts a picture of her #motd (makup of the day) using Jeffree Star's makeup products

- Here is an example from Gia Escobar who tweets a video of her in lip gloss with the caption saying that she has her new lip gloss on and that it makes her feel like a new person

- Here is an example of Crystal Perea jokingly tweeting about how on some days concealer does not hide how tired they are under their eyes. For concealers, there were many conversations from U.S. Hispanics who would jokingly tweet about their concealers and how tired they were

- A major driver for lip gloss was the release of Jeffree Star's new lip gloss that resonated very well among Hispanic females

- Here is the example from Jeffree Star who posted about his new lip gloss that he was going to launch. This post was popular among Hispanic females

- Future Purchases (2.7%) is a category that captures post from Hispanics talking about buying makeup products

- Below is an example of a video tweet of someone applying the lipstick product on to which Elisa Ramos replies saying that she needs to buy that lipstick product

- As previously mentioned, recommendations and reviews were popular topics that Hispanics would post about. Data showed that Hispanics relied heavily on online recommendations and reviews to influence their purchasing decisions

- The most popular brands mentioned by Hispanics were E.L.F. Cosmetics, MAC, Maybelline, Clinique, and Tarte Cosmetics

- Among Hispanic respondents, the most popular products for makeup was foundation followed by the concealer and face powder.

- Maybelline was a popular go-to brand for Hispanics for makeup products such as concealers, blush, lipstick, lip gloss, and lip balm

- Too Faced Born This Way was a popular brand among several of the respondents for products such as foundation and mascara

Topic Analysis - Skincare

- For skincare, the top categories were Sunscreens (38.1%), Face Masks (30.1%), Moisturizers (9.3%), Exfoliators (6.7%), and Toners (6.4%)

- The most popular skincare products for Hispanics during the time range of the analysis were Sunscreens (38.1%), Face Masks (30.1%), Moisturizers (9.3%), Exfoliators (6.7%), and Toners (6.4%)

- Here is an example of Camila Coelho, a fashion and beauty influencer (277.2K followers), who posted about loving neutral bronzy makeup during summer as well as mentioning a sunscreen product that is great for women to apply before putting their makeup on

- Here is an example from Yvonne Aguilera tweeting that face masks make her feel better

- Here is an example from Dannella Muñoz who posts about taking her time doing her entire skincare routine and applying moisturizer was a part of it

- Here is an example from Jilly who tweets asking about any recommendations for exfoliator products to which Jason Zuniga replies and informs her that Dermalogica's exfoliator works really well and that the products are inexpensive

- Here is an example from Mariana Rodriguez who tweets about her love for OleHwnriksen products and specifically mentions their toner

- The most popular skincare brands mentioned online by Hispanics were Kiehl's, Mary Kay, St. Ives, Elizabeth Arden, and Neutrogena

- During the time range of the analysis, it is no surprise for Sunscreen (38.1%) to be the most mentioned skincare product among Hispanics. In several posts, Hispanics mentioned that the warmer seasons required them to hydrate and protect their skin more

- Only products appeared in the topic analysis for skincare. On the other hand, makeup had only three of the five top categories as products

- The most common products that Hispanics talked about during the qualitative interviews for skincare included moisturizers and sunscreens.

- The main difference between age groups were specific brand preferences and how they shopped. In general, younger respondents had a greater brand spectrum and were more open to trying new products whereas older participants mentioned using the same traditional brands for many years

- These were several of the brands mentioned by younger Hispanic respondents:

- VDL, TwoFaced, Mac Bronzer, Real Techniques, Bare Essentials, Makeup Forever, Clean & Clear Cleanser, Up&Up, Banana Boat Sunscreen, Elizabeth Arden, Drops of Youth - Body Shop (Serum), Charcoal Mask - Beauty and Touch, Precision Beauty (Collagen masks), Mary Lou, Smashbox, Eyeko, Neutrogena, Thayers, Yes, Clinique

- These were several of the brands mentioned by older Hispanic respondents:

- Revlon, Loreal, Lancome, St Ives, Cetaphil Cleanser, St Ives, Vaseline, Olay, Maybelline, Porcelaine, Mary Kay, Channel, Kiehl’s

- These were the skincare brands mentioned among several of the older male respondents:

- Nivea, Dessert Essence, Kiehl’s, Vaseline

Influencers

Hispanic Influencers - Makeup

Latino Influencers (over 150K followers) and micro-influencers (those between 1K and 150K followers) can be leveraged throughout the year to boost product awareness and influence Hispanic consumers to consider new campaigns

- Important to note, three of the four Hispanics influencers (Daniela Ruah, Rocio Cervantes, and Diana Saldana) were from the state of California which was the top city in the top 10 US locations graph for makeup.

- Three of the four Hispanic influencers (Camila Coelho, Rocio Cervantes, and Diana Saldana) were in the beauty blogging business.

Hispanic Influencers - Skincare

- The Hispanic influencers for skincare were Gaby Espino, Amra Olevic Reyes, Remi Cruz, and Mirella Bernal

- Remi Cruz is from Los Angeles, CA which was the top US location for skincare. However, unlike Makeup influencers, Remi was the only skincare influencer from California

- Amra Olevic Reyes was Hispanic influencer from New York City which was the third highest location among the top 10 US locations

- Remi Cruz and Mirella Bernal are both in the beauty blogging business

- Among the respondents, the internet remained the main source of information for new products. Youtube was the biggest media source to watch influencers recommend specific styles, products, and brands

- For Hispanic females, friends were a major influence when deciding the brands and products they would buy

- For Hispanic males, their partners were the most relevant source that influenced which products to buy

- Word of mouth from friends and family members continued to be a relevant source of information for many of the Hispanics interviewed

- Key influencers for younger respondents:

- Media sources: Instagram and Youtube Hispanics: Ana Gabriela, Bethany Moda (MacBarbie), Jeffree Star, Myra touch of Glam General Market influencers: realpaigewe, Lauren Elizabeth, Kaia Quinn, Katie Cho

- Key influencers for older respondents:

- Media sources: Mainly from traditional media channels (Univision) and Facebook Celebrities: Jennifer Lopez, Sofia Vergara, Jorge Ramos

Top Shared Posts

Top Shared Posts - Makeup

- Top shared posts allow us to understand what kind of content is popular and attracts Hispanic consumers. This data helps brands to understand what sort of content provokes engagement from U.S. Hispanics.

- A post from n and Jeffree Star were the two top shared posts among Hispanics during the time range of this analysis.

- Posts showcasing the product in use was very popular among Hispanics as it gave them a preview of what it might look like when they try it on. The post from n on the top left received 15K retweets with 80K likes.

- The post on the top right from Jeffree Star which received 5.8K retweets and 78K likes was popular due to the influence Jeffree Star has within the beauty community.

- Important to note, Hispanics enjoy visual and vibrant content as shown by the two top shared posts.

Top Shared Posts - Skincare

- For skincare, Veronica Gorgeois and Hassan Sayyed's posts resonated well with U.S. Hispanics.

- During the spring and summer seasons, Hispanics are very concerned about keeping their skin hydrated and protected. This is why Veronica's post on the bottom left showcasing a truck driver's skin facing the driver's window resonated well with Hispanics. It showcases the damage that can be done to your skin if you do not give it the proper self care.

- Sun damage is among the top concerns for Hispanics as illustrated by Sunscreen being the biggest category Hispanics talked about during the study and the top shared post from Veronica.

- The other top shared post for skincare was another post regarding skin protection. This time the video from Hassan mentions that walnut exfoliators give people's skin micro fiber tears and to stop using them. As shown in the topic analysis, exfoliators are among one of the most popular skincare products that Hispanics post about online.

Wordcloud

Wordcloud Analysis - Women

- For women, wearing makeup is a way of enhancing their beauty and feeling good to be accepted by their family – especially their moms and friends

- Most repeated unique words included family, mom, and color.

- Overall, Hispanic female respondents mentioned having a greater variety of beauty products to choose from than men for both makeup and skincare

- The most common product was moisturizers and the least common one was eye creams.

- For makeup, foundation was the most popular product. The Hispanic female respondents mentioned this being a go-to beauty product and all of the female participants owned foundation

- For Hispanics, the perception of beauty is something that is primarily seen as more feminine, but also as someone who is clean, presentable, young, and healthy

Wordcloud Analysis - Men

- For Hispanic male respondents, what was most important was feeling clean and presentable

- The most repeated unique words were think, lotion, and shaving

- During the interviews, men mentioned they don’t really talk about beauty products with friends as much but rather learn about beauty through their partners.

- Men in the study didn't typically purchase makeup products. Only one respondent mentioned owning concealer to cover a scar.

- Instead, the men focus more on their skincare by applying “moisturizer”, “sunscreen”, and “cleansers”, according to the results from the study.

CONCLUSION

What Does Beauty Mean to Hispanics?

- In general, Hispanics like to feel good and look presentable and they put a lot of value into what their family, friends, and colleagues at work think of them.

- Beauty for Hispanics is a combination of having a clean face and skin, being able to enhance your features, and being presentable because they care about what others will think. While beauty is generally understood as something that exists within an individual, most Hispanics interviewed for this study accepted that how you present yourself outside will tell a lot about who you are inside.

- Hispanic females associate beauty (makeup and skincare) with confidence and commonly would post about how confident they felt whenever they had their makeup done right.

Who Influences Hispanics?

- Hispanics are deeply connected to their communities (online and offline) which creates a higher desire for belonging and acceptance. Their families and friends are some of the main influencers in their day-to-day decisions on how to behave and what beauty products to buy.

- Social networks have become one of the main sources for Hispanics to learn about beauty trends, styles, new products, and product quality. Based on the data collected, Jeffree Star is a big player in the beauty industry among Hispanic females as they anticipate Jefree's newest product lines and hold his reviews of other beauty products to a high degree.

Who is More Involved Online/Offline?

- Bicultural/Bilingual Hispanics are more engaged in online Beauty-related conversations (on social networks) than less acculturated (Spanish only) Hispanics who are more traditional observers and followers rather than active participants.

- While Hispanics online are speaking and participating in online Beauty-related conversations primarily in English, Spanish Beauty-related conversations do happen inside of their homes and with friends and family, who also happen to be the most influential people in their purchasing decision process most of the time.

- Among U.S. Hispanics, makeup conversations were more popular than skincare online conversations. For makeup, data showed us that it was common for English posts to be coming from a younger demographic of Hispanics while Spanish posts typically were from an older demographic of Hispanics

- For makeup, Hispanic females (76.1%) made up the majority of online conversations compared to Hispanic males (23.9%). Hispanic females would post online either looking for other products to try, reviews, recommendations, or to see what new products their beauty influencers were posting about while Hispanic males found it attractive when females did their makeup or simply took care of themselves.

- For skincare, Hispanic females (64.9%) made up the majority of online conversations than males (35.1%). There is a larger presence of Hispanics males for skincare (35.1%) than among makeup (23.9%) conversations. Face masks were the most popular product among both Hispanic males and females.

- Overall, Amazon was the most popular retailer across the respondents (both older and younger) followed by Walmart, Macy’s, and Target. Sephora and Ulta were the most popular stores for younger Hispanics respondents to shop at.

- Most of the interviewed Hispanics said that they like to go to the stores to test the products if they are buying them for the first time. Younger respondents were more open to buying online if it was for the first time since a majority of the time they can only get the products from a specialty store.

What is the Most Popular Product for Makeup and Skincare?

- The most popular products among Hispanics were products that helped maintain young and healthy skin. As a result, these were the most popular products among Hispanic respondents:

- Moisturizers and sunscreens were the preferred skincare products in general for Hispanic males and females (younger and older)

- Foundation and concealers were the preferred products for makeup, particularly mentioned by women (both younger and older)

- For makeup, the most popular products mentioned among Hispanics during the time range of the analysis were Lipstick (34%), Lip Gloss (25%) and Concealers (17.3%). The most popular brands mentioned by Hispanics were E.L.F. Cosmetics, MAC, Maybelline, Clinique, and Tarte Cosmetics.

- The most popular skincare products among Hispanics during the time range of the analysis were Sunscreens (38.1%), Face Masks (30.1%), Moisturizers (9.3%), Exfoliators (6.7%), and Toners (6.4%). The most popular skincare brands mentioned online by Hispanics were Kiehl's, Mary Kay, St. Ives, Elizabeth Arden, and Neutrogena.

What Does This Mean for Brands Who Want to Reach Hispanics?

- Beauty products that help Hispanics look young and fresh tend to have a higher acceptance and be more popular. Beauty products that position themselves as being able to “bring out the best from within” can connect better with Hispanics.

- Beauty products that want to target Spanish speaking Hispanics, both younger and older, should maintain budgets in magazines, TV, radio, etc. while beauty products looking to reach Hispanics through influencers should find trustworthy personalities that connect to this community through its values, heritage, and language.

- Regarding social channels, brands should utilize channels such as YouTube, Twitter, and Instagram to showcase their products in use as this was very popular among Hispanics as it gives them a preview of the product.

- During spring and summer seasons, we found that Hispanics are very concerned about keeping their skin hydrated and protected. Sun damage is a crucial concern for many Hispanics, therefore, beauty products should use this knowledge to prioritize strategies or promote new products during spring and summer.

- Brands should note that if they want to reach a younger demographic of Hispanics they should post in English as this is the language that younger Hispanics post and relate to.

Contact Us

EMAIL: info@oyeintelligence.com I info@interculturalstudio.com

WEB: www.oyeintelligence.com I www.interculturalstudio.com

PHONE: 650-530-6502