Credit Card Preferences

—

Multicultural Analysis

Overview

—

OYE! listens to consumers in their own space online and delivers insight on what multicultural consumers have to say about your brand and/or industry. Understanding consumer attitudes towards brands, their products and their marketing efforts provides our clients insights that inform their multicultural marketing strategy.

Actionable Insights

OYE! is a language neutral social listening software that analyzes conversation in all languages to derive meaning from unstructured social conversation among multicultural consumers. OYE!’s natural language processing solution is designed not only to identify African American and Hispanic consumers of all levels of acculturation, but to also derive insights marketers can use in campaign strategy, messaging and targeting.

The Solution

Insights derived from social conversation by OYE! provide key details into multicultural consumers through their own statements about brands. OYE! analyzes that conversation to allow brands to understand better ways to interact with these groups. OYE! also provides insights on how to create campaigns tailored to these multicultural consumers.

The Value

Leveraging insights from OYE! allows clients to produce content for multicultural consumers most influential over purchasing decisions for your brand where they want it, when they want it and how they want it. The result: Better conversion, lift and engagement.

Methodology

This analysis was extrapolated from a data set of 22,567 conversations on Twitter, of which 2,999 were from verified Hispanics and 736 were from verified African Americans. All the data was gathered from 04/20/2019 – 05/20/2019.

Contents

Volume & Language Analysis | Gender Analysis | Sentiment Analysis

Location Analysis | Topic Analysis by Ethnicity | Topic Analysis by Language

Influencers | Top Shared Posts

Volume & Language Analysis

Volume by Ethnicity

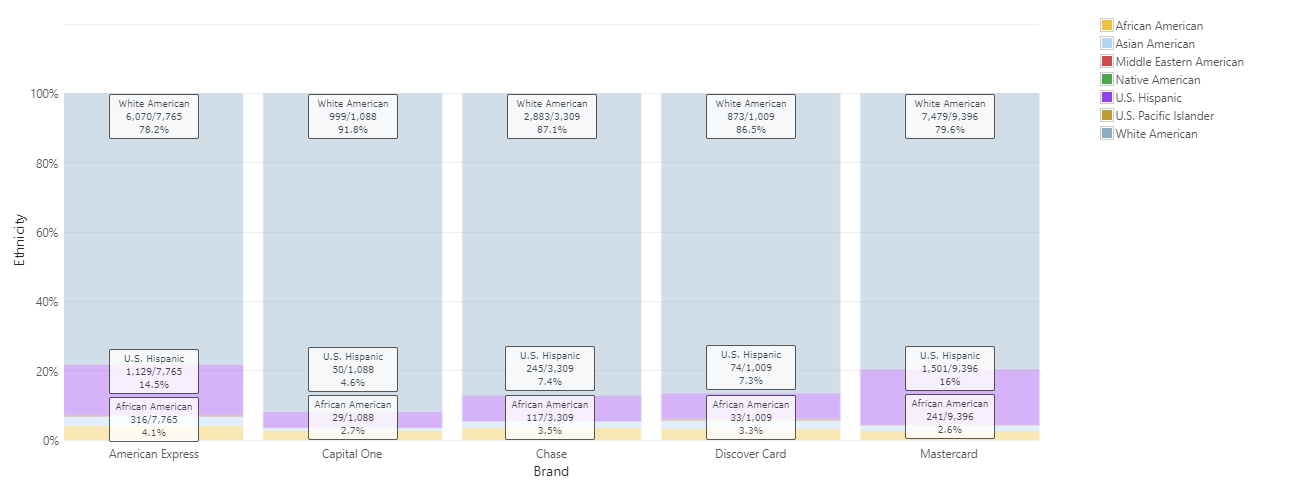

- U.S. Hispanics made up 13.2% (2,999) of overall conversations, over quadruple the percentage of conversations generated by African Americans at just 3.2% (736).

- The brands with the highest Hispanic percentage were MasterCard (16%) and American Express (14.5%).

- The brands with the highest African American percentage were American Express (4.1%), Chase (3.5%), and Discover Card (3.3%).

- By looking at just percentages, American Express was the most popular brand among African American conversations ranking marginally higher (0.6%) than Chase. Similarly, MasterCard was the most popular among U.S. Hispanics beating out American Express by 1.5%.

Hispanic Language Analysis

- MasterCard generated the highest portion of Spanish language tweets while American Express led in Bilingual conversation. Discover Card meanwhile led in English conversation, with a whopping 94.5% of tweets in English.

- Para todo lo de más, existe MasterCard (For everything else, there's MasterCard) is a popularly used slogan among Hispanics because the phrase was marketed by MasterCard in ads. The tagline, which states that there are things that money can't buy, but for everything else, MasterCard can buy it; was popular among Hispanics who use it as a meme.

- An example of a Spanish MasterCard tweet would be Jose's who tweets about a video saying, "Es como Mastercard, no tiene precio." This falls in line with MasterCard's slogan by saying that the moment in the video was priceless, like MasterCard.

- An example of a Bilingual American Express tweet would be Juan's who recognizes the winner of the American Express Icon award saying "Grande @chefjoseandres! So proud".

- An example of an English Chase tweet is Jeff's who says that he's "Been waiting on [his] Chase replacement card for a while, and is tired of using [his] backup account".

Gender Analysis

Hispanic Gender Analysis

- The majority of conversations came from Hispanic males (69.8%) as opposed to Hispanic females (30.2%).

- An example of an American Express tweet by a Hispanic male is Sean's, who's tweet is mocking people who use the Cash App Card as if it is an American Express Black Card.

- Hispanic females made upwards of 32% of conversations among all brands; however, American Express had the lowest female percentage (21.3%).

- Discover Card was the most popular brand among Hispanic females at 45.6%. However, this was based on only a small volume of posts (57).

- An example of a credit card tweet by a Hispanic female is Cynthia's who expresses her discontent with Capital One's fees which made her switch to Discover Card and American Express.

African American Gender Analysis

- The majority of conversations came from African American males (72.5%) as opposed to African American females (27.5%).

- Capital One had the lowest percentage among African American females (21.4%), however, the low volume of tweets analyzed (14) should be taken into consideration.

- Overall, African American females were marginally less (2.7%) involved in conversations about credit card companies than Hispanic females.

- Based on the data, it can be inferred that males talk about credit cards more than females do, at least among the two largest U.S. minority groups.

- An example of an American Express conversation from an African American male is Justin's who asks about card preference, Platinum or Aspire.

Sentiment Analysis

Hispanic Sentiment Analysis

- Discover Card had the most positive sentiment (83.3%) among Hispanics, however at a low volume (30).

- Many positive tweets are about the benefits of each respective credit card, like Ashley's who says she loves that Chase sends her updates about her credit score and Omar's who recommends Capital One to his followers that have good credit and like to earn rewards.

- Negative tweets were mainly criticism of high interest rates, bad credit, or poor service like Jorge's tweet complaining about MasterCard having his address wrong and Adrian's tweet when he laments "Chase has canceled my card 4 times in the last 2 months how annoying".

African American Sentiment Analysis

- Chase had the highest negative sentiment among African American users (17%), however, there were only 47 tweets to evaluate.

- Positive tweets about the brands were about their increased spending limits or card member rewards like Tatiyana's who says that she retweeted for good luck and it worked because "Discover extended my credit limit god bless" or Frank's who is impressed that Chase automatically transfers points to his Southwest Card.

- Negative tweets were usually complaints to companies like Greg who received bad customer service while updating his American Express Card and was then penalized for downgrading or Chelsea's who says "Chase profits off of keeping people poor w/ overdraft fees, high credit card interest rates, etc."

- Two of the brands were able to generate 100% positive sentiment among African Americans: Capital One and Discover Card. However, it is important to take into consideration the low volume for both companies (7 and 10 tweets respectively).

Location Analysis

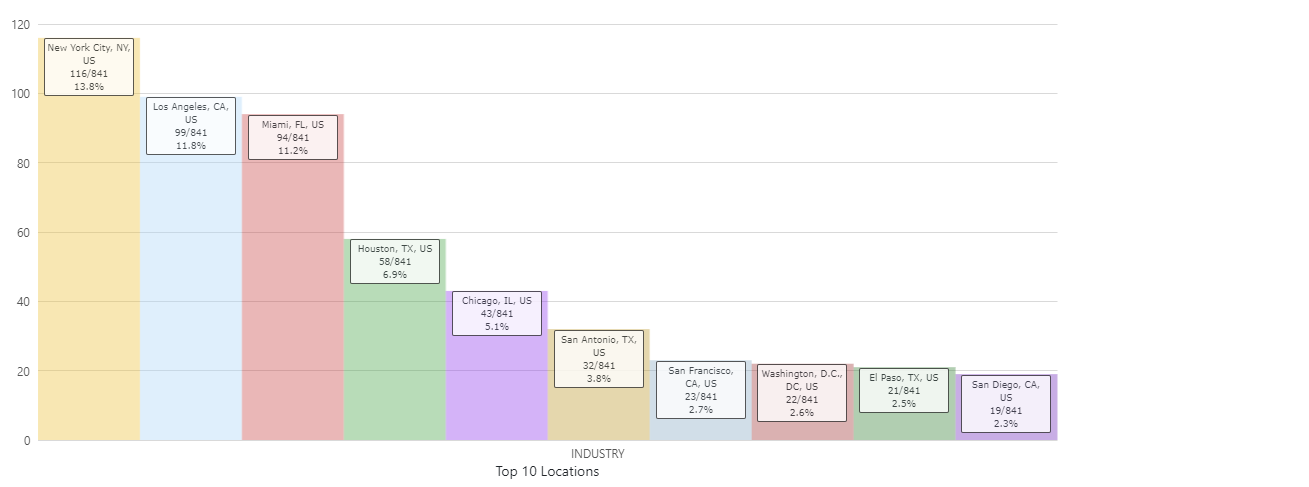

Hispanic Location Analysis

- The highest volume of Hispanic Twitter users conversing about the five credit card brands came from New York City, NY (13.8%).

- Many of the conversations in New York City, revolved around concerts with Credit Card Member Pre-Sales, like concerts for Logic and the Jonas Brothers.

- Another trend that's gaining traction in NYC is how MasterCard sponsored a Harvard Business Review report about using diverse tech talent to compete with fin-tech.

African American Location Analysis

- The highest volume of African American Twitter users conversing about the five credit card companies came from Detroit (14.6%), which was only marginally more than Washington D.C. (14.1%)

- African American twitter users in Detroit tended to tweet about credit card fraud and/or why they were canceling their credit cards

- In response to Chase's now-deleted tweet about why a fictitious person's balance is low, Georgina tweeted about Chase's failure to recognize suspicious activity in Atlanta while she was still making her own purchases in Detroit.

- Tonya explains her reasoning for cancelling her Macy's American Express being their poor "transaction reporting accuracy", customer service, and "poor fraud protection".

Want the Full Version?

The Full Version contains the following:

- Topic analysis comparisons between Hispanic and African American consumers

- Topic analysis comparisons between English-speaking, Spanish speaking, and Bilingual Hispanic consumers

- Top shared social media posts among Hispanic and African American consumers

- And comparisons between top influencers from the Hispanic and African American audiences

Contact Us

OYE Offices

Columbus, OH: 1275 Kinnear Rd, Columbus, OH 43212

Phoenix, AZ: 3428 N. 15th Ave, Phoenix, AZ 85015

EMAIL | info@oyeintelligence.com

WEB | oyeintelligence.com

PHONE | 650-530-6502